TUATARA at IT@BANK – AI governance in the era of the AI Act

In November, we participated in one of Poland’s most important technology and finance events – IT@BANK in Warsaw. During the conference, Tomasz Kostrząb, our Chief Technology Officer, presented a demo of the watsonx.governance platform. It’s designed to monitor and manage AI in light of the AI Act.

This event was a great opportunity to showcase how to approach AI development and management in compliance with regulations. The demo highlighted the platform’s role in ensuring transparency and security for AI-based systems.

Transparency and compliance with privacy regulations

According to a report by PwC, 75% of financial companies plan to increase their investment in AI over the next two years. That will lead to a rise in AI model governance. Financial institutions should aim for maximum transparency in how AI algorithms are used. Customers need to understand how AI models make decisions and what data is utilized in these processes.

Implementing risk management systems to address potential threats associated with AI usage is critical for ensuring long-term safety and compliance. This is particularly relevant under privacy regulations such as GDPR and the AI Act, which focus on the principles of AI deployment. Responsible AI governance helps protect customer data and ensures compliance with strict legal requirements.

The implementation of compliance management solutions, such as the watsonx.governance platform used by TUATARA supports financial organizations in maintaining transparency.

These tools assist in:

- managing documentation and reporting processes,

- improve operational efficiency,

- and protect the companies’ reputation, which leads to greater client trust.

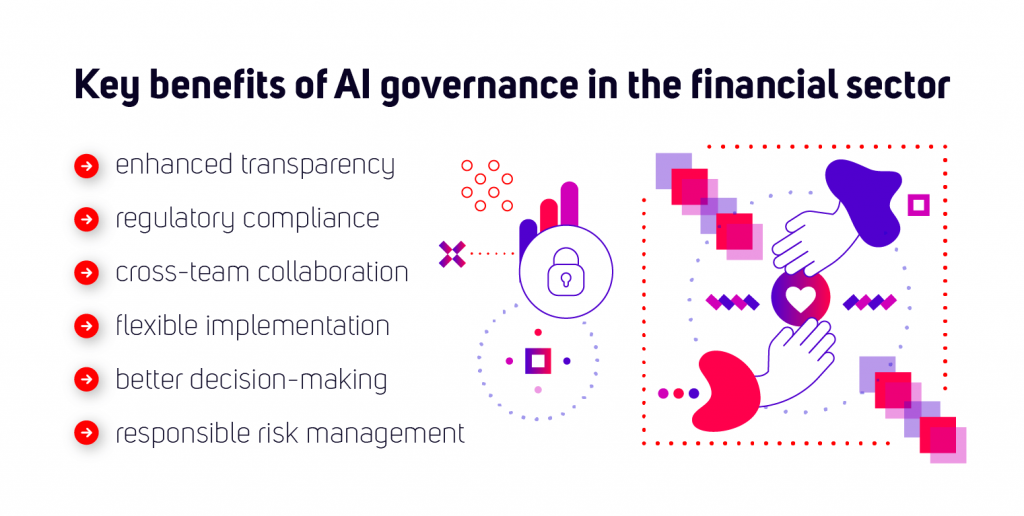

Key benefits of watsonx.governance for AI governance in the financial sector

The watsonx.governance platform provides numerous advantages for financial institutions aiming to manage AI effectively while ensuring compliance with regulations. Below, we outline the key benefits and how the platform meets them.

Enhanced transparency

The platform enables centralized AI governance, allowing banks to monitor performance and usage from a single location. This centralization improves visibility, simplifies problem detection, and optimizes processes.

The platform also offers visualization tools that provide insights into:

- model performance,

- support better risk management and compliance,

- and build customer and partner trust.

Regulatory compliance

The EU’s AI Act requires complete transparency and accountability for AI usage. The watsonx.governance platform equips financial institutions with tools to meet these requirements. It includes features to create proper documentation and generate compliance reports. By adopting such a solution early, banks can avoid significant financial penalties. Those can:

- reach up to 7% of annual turnover for violations related to prohibited systems,

- or €7,5 million for failure to provide incorrect, incomplete, or misleading information.

Cross-team collaboration

One of the platform’s standout features is an advanced risk management dashboard. It supports collaboration between different departments within financial institutions.

Risk teams can identify potential threats to implement preventive actions. Data science teams can test and optimize AI models based on available data. Finally, validation teams can verify the compliance and reliability of AI algorithms before deployment.

This advanced dashboard enables effective communication between teams with diverse expertise, ultimately speeding up decision-making processes and reducing operational risk.

Flexible implementation

The platform supports financial institutions implementing AI models across:

- public,

- private,

- and on-premises environments, giving them complete control over data processing.

This flexibility is crucial for institutions that must comply with various regulatory requirements or need to meet clients’ preferences for data privacy.

Better decision-making

Advanced data analytics and AI algorithms enable more informed financial decisions. Real-time insights provided by the watsonx.governance platform allows managers to respond swiftly to market changes and develop new business strategies. Predictive analytics tools empower banks to achieve 15–20% better financial outcomes compared to institutions that don’t use such technologies.

Responsible risk management

AI management tools help identify potential risks associated with using AI technology and support the implementation of appropriate preventive measures. Risk management dashboards visualize risks for both traditional machine learning (ML) models and generative artificial intelligence. It allows institutions to better safeguard customer data and ensure compliance with strict legal requirements.

What benefits does a financial institution gain by using the watsonx.governance platform?

- A unified view – Enables the management of all models in one centralized place, regardless of the technology provider (such as Amazon, IBM, Google, or Microsoft Azure) or deployment environment (whether in the public cloud, private cloud, or on-premises).

- Regulatory compliance – Simplifies compliance with regulations like the AI Act by automating documentation and auditing processes.

- Full transparency – Provides continuous insights into model operations, performance, and outcomes, enabling quick identification of potential risks.

- Improved risk management – Promotes collaboration between risk management, model validation, and data science teams thanks to the centralized dashboard, accelerating and simplifying the mitigation of AI-related threats.

- Model lifecycle optimization – Supports every stage of the model lifecycle, from deployment to monitoring, risk management, and compliance, speeding up operational processes and ensuring comprehensive control over model development.

- Technological independence – Offers flexibility in managing models deployed across various environments and using various technologies, enhancing the scalability and adaptability of AI solutions.

How to use Artificial Intelligence responsibly?

Introducing the AI Act in the financial sector presents institutions with numerous regulations, transparency, compliance, and risk management challenges. To effectively address these challenges, banks and other financial organizations must invest in appropriate technologies and employee training. Proper AI governance ensures legal compliance, enhances operational efficiency and builds customer trust.

Implementing the watsonx.governance platform early in the development of AI-driven systems enables financial institutions to avoid many challenges that may arise as the number of AI models increases.

Do you want to effectively support your financial institution in AI governance?

TUATARA is your trusted partner in this technological transformation! Contact us today, and we’ll help you exceed your customers’ expectations.