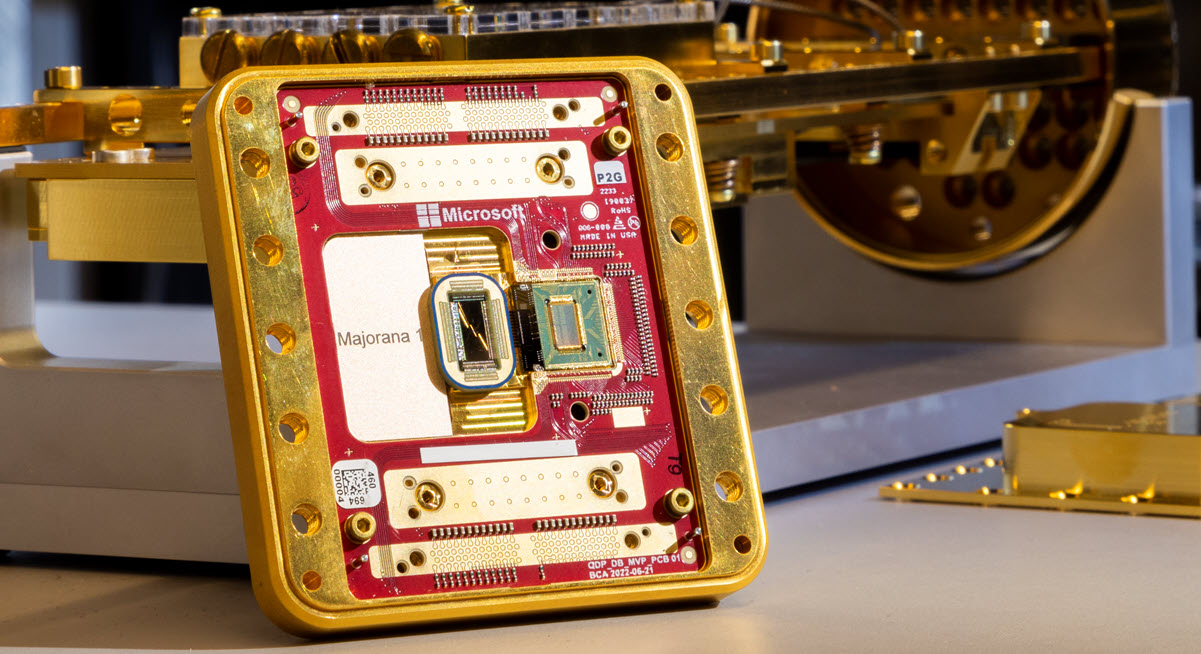

Microsoft unveiled a quantum computing breakthrough with the Majorana 1 chip, which can fit a million qubits on a single chip, promising transformative advancements in quantum computing:

It leverages the world’s first topoconductor, a breakthrough type of material which can observe and control Majorana particles to produce more reliable and scalable qubits, which are the building blocks for quantum computers. In the same way that the invention of semiconductors made today’s smartphones, computers and electronics possible, topoconductors and the new type of chip they enable offer a path to developing quantum systems that can scale to a million qubits and are capable of tackling the most complex industrial and societal problems, Microsoft said.

Exclusive: Anthropic's "index" tracks AI economy

The new Anthropic Economic Index is an ambitious effort to track the impact of AI adoption.Read the article onaxios.com

The newly launched Anthropic Economic Index provides unprecedented, data-driven insights into how AI is transforming work and the economy. Based on millions of anonymized interactions with Anthropic’s Claude AI model, the index offers a real-world view of AI adoption patterns and their implications.

Why it matters: The new Anthropic Economic Index is an ambitious effort to track the impact of AI adoption by directly analyzing anonymized data on how people are using Claude, Anthropic’s chatbot. The big picture: Today, only AI providers have a direct view of what people are actually doing with their tools. The more information AI makers share with the world, the better we’ll be able to understand how the new technology is changing our lives.

BNY, America’s Oldest Bank, Signs Multiyear Deal With OpenAI

BNY will gain access to OpenAI tools, such as Deep Research.Read the article onwsj.com

America’s oldest bank embraces the newest technology. BNY Mellon has launched a multiyear partnership with OpenAI to enhance its AI transformation strategy. This collaboration aims to improve its enterprise AI platform, Eliza, which helps streamline workflows for employees.

Under the deal, America’s oldest bank will gain access to cutting-edge OpenAI tools such as Deep Research and its most advanced reasoning models, supercharging the bank’s internal AI platform, Eliza. In return, OpenAI said it hopes to gain insight into how well its models work for complex tasks in the real world.

The UK Treasury Committee has initiated an inquiry into the impact of AI on banking and financial services. This inquiry aims to explore how AI can be leveraged while managing associated risks, particularly regarding consumer protection and employment within the sector.

This inquiry could explore how AI is currently used by City firms as well as what opportunities it brings for innovation in the financial services sector. MPs may also consider the potential impact on employment in the sector and ask how the UK compares to other countries in both its competitiveness and approach.