Eventually, we have come to the point in which the API has consumerised enough to allow entrepreneurs to see further possibilities it offers. Identified recently, highly promising business potential, the API Economy, is an Open API-based business model, pursuant to which, companies choose easy to integrate services from a portfolio of public and private APIs, thereby aiming to satisfy their customers’ needs better.

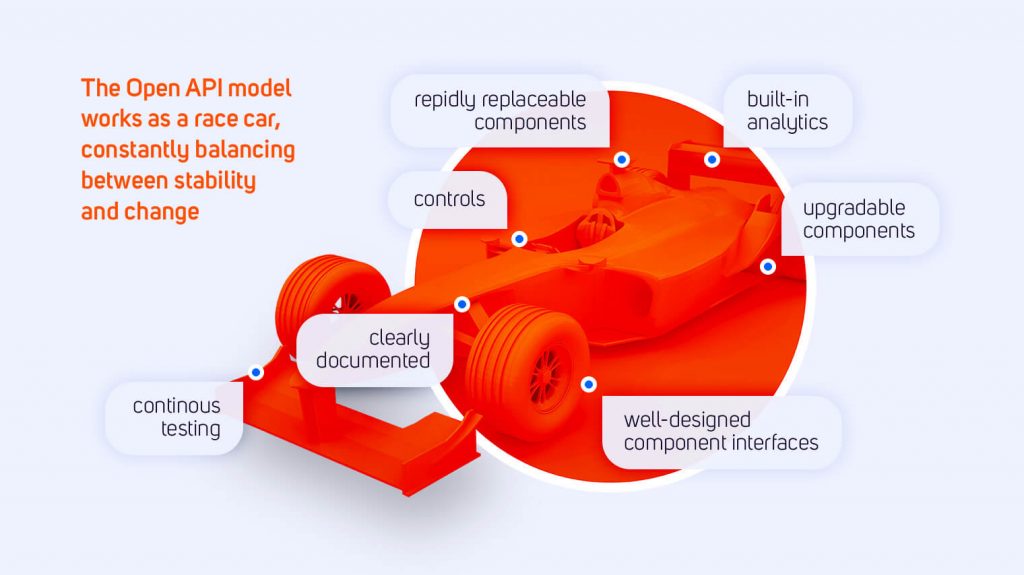

Taking part in a race for business benefits

A modern, advanced enterprise is like a racing Formula One car. It takes part in a continuous race to achieve business goals, striving to outperform the competition. A constant search for the balance between stability and change and ensuring it is a prerequisite for victory. Each racing Formula One car is unique. Well-designed interfaces enable building a racing car with fast-changeable components. Its heart contains controls and built-in analytics. A machine is neatly and clearly documented so that, before the next race, some parts can be optimized, while maintaining the stability of the whole vehicle. The open API model is based on the same principle. It allows experimenting, quick implementation of new ideas and optimization while keeping business continuity. Change is what is necessary to move further, but in order to be able to go far enough to achieve the goal, it is essential to preserve the stability of the functioning. Using APIs gives a company the ability to maintain the balance between change and stability, at the same time equipping it with a powerful competitive advantage over other companies.

Implementation of the API Economy model has been a facultative option so far. Companies and organizations from various industries have decided to enter into the API Economy model on their own initiative. They have seen this step as a chance for themselves to become market innovators, bearing in mind the “first takes all” principle.

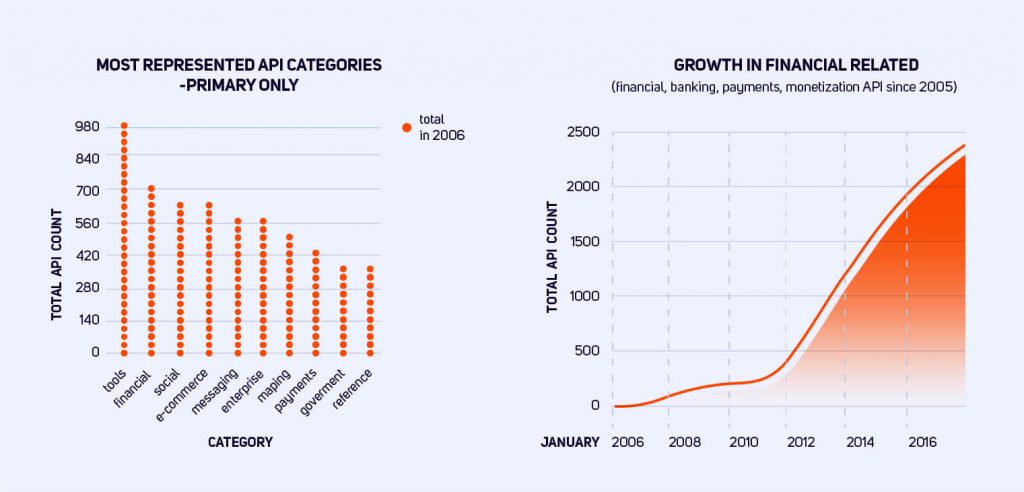

Financial APIs in pole position

Financial institutions have been providing their services through API for several years now, making it the second most popular API category of all. But the category is still growing, quicker than ever before.

Banks, through Open APIs, provide access to some of their data resources to selected and trusted business partners. Services, created on the basis of banking resources, have the potential to expand beyond banking itself. Only the creativity of banks and their accelerator partners limit this potential. Some of the ideas may include:

- sharing of account data and card payments data to third parties

- real-time, personalized offers, triggered by customer’s activity, alerts, location and time

- execution services such as a change of supplier or purchase of retail offerings

- product pricing or price comparison and location-based services

Such services will support creating new products that will provide the customers with budget management assistance, expense analysis, debit alerts, banking reminders or customer action’s suggestions. Open API will allow the customer to use all of his investments, credit offers and financial services in real-time, which will be extremely beneficial for pay-as-you-go services such as health insurance per hour while skiing.

Alior Bank has an ambition to become the leaser of financial APIs in Poland

Open API implementation and entering into the API Economy not only supports the culture of innovation but also opens the door for collaboration with new partners, providing both parties with new business opportunities. Alior Bank SA. has just announced establishing two new units, the Centre of Innovation and Acceleration Programme, thus opening a new chapter in the history of Polish banking.

Alior Bank’s FinTech Department Director, Mariusz Ożga, sees Open API implementation, and incoming collaboration with external companies, as a chance for transforming traditional banking into a universal platform that enables meeting a wide range of consumers’ needs. Alior Bank SA has plans to create a marketplace, allowing customers to choose additional services from a range of those offered by the bank’s partners. Alior Bank also plans on building a convenient solution that allows the user to view funds on all of his accounts, including those in banks other than Alior Bank, all in one place.

TUATARA is pleased it has been chosen to provide and implement the Open API solution for Alior Bank SA. We are proud that we have been entrusted with this important role of implementing the first Open API solution for the banking sector in Poland. The API Management platform will include a billing and monetization module, a portal for developers and a users’ communication module. Service lifecycle management solution, IBM API Connect, will allow internal users to configure, design and manage services’ lifecycle and will also enable external users to create applications based on the bank’s API. IBM API Connect and Data Power Gateway will ensure highest data security standards are kept. We plan to launch the first service as quickly as within a dozen or so days since the platform goes live. In addition, implementation of the solution will ensure the bank’s compliance with the PSD2 directive.

API economy – with an experienced team the chances for victory are bigger

TUATARA gained unique experience in accelerating the API Economy thanks to its innovative solutions developed for the Persian Gulf countries. We have built a model, based on cooperation with telecommunications operators, banks, retailers, online content providers and the Programmatic Advertising ecosystem and we are launching a service that will enable advertisers to run multichannel, highly targeted marketing campaigns, based on securely processed, integrated data from multiple sources. This unique project proves that collaboration between entities deriving from different industries results in creating new sources of revenue for each exchange participant.

We have experience not only as a provider of API Management solutions but also as a participant and a catalyst for the creation of added value derived from the collaboration of partners from various industries. Therefore, we can well and truly say that the API Economy revitalizes the market, strengthens the chances of obtaining multi-dimensional benefits and sets a certain path for entrepreneurs – a path to modernity, to innovation and to the future.