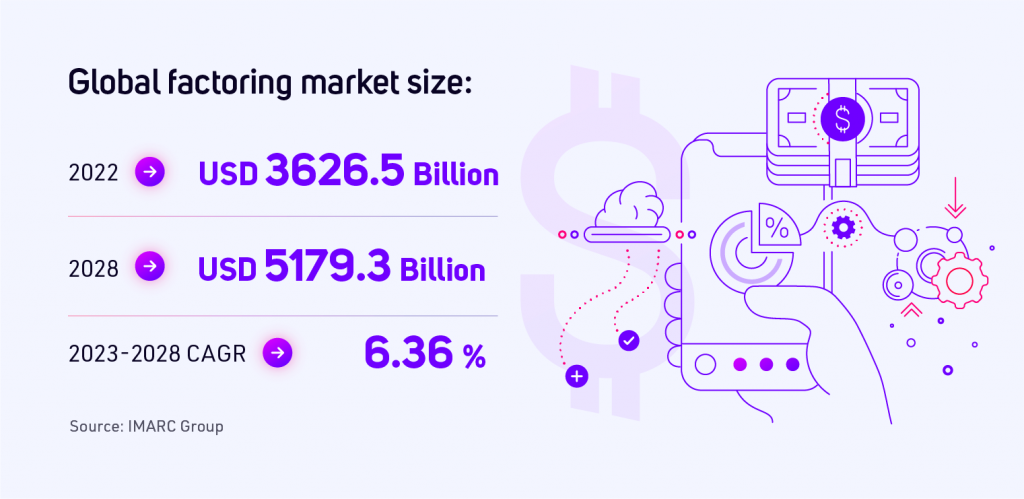

Factoring industry’s growth and the need for automation

According to data from the Polish Factors Association, in 2022, affiliated companies purchased receivables worth a total of PLN 460 billion. This is almost 27 percent more than in the same period of the previous year. Factoring services were used by around 25,000 companies in Poland, transferring almost 24 million payment documents.

The dynamic growth of the market and individual companies forces the development of tools to support the provision of new products or forms of financing. Today, to effectively scale their business and compete with other corporate financing instruments, factoring providers need to embrace technology. Providing modern forms of financing requires integration with the business ecosystem. To ensure this, factoring companies should rely on plug-and-play, modular solutions. The increase in data volume and the growing portfolio of customers covered by financing mean new challenges in the handling of processes, for which automation may be crucial. Ensuring better workflows and customer requests handling is a necessity for adapting to a rapidly changing business environment and offering better value to its customers.

Factoring companies no longer must rely solely on building automation solutions by. Thanks to rapid advances in AI, machine learning, and computer vision technologies, they now can implement powerful and highly customisable, modular automation tools even in a matter of weeks. This opens new ways for growth, allowing factors to focus on delivering value to their customers and growing their businesses. In addition, automation can help factoring providers manage risk more effectively by identifying potential problems early and taking appropriate action.

Intelligent, AI-based automation is a huge opportunity to increase competitiveness among factoring providers and, in turn, drive market growth. What trends and developments should the factoring industry be looking at in 2023?

Embedded factoring

Embedded Finance is a growing trend to integrate financial services with non-financial products or platforms, such as accounting software or e-commerce platforms. This allows customers to easily access financial resources, within the same system they use to run their business or use different types of financial services when making purchases.

These types of solutions are already successfully used by banks, insurance or leasing companies and can also be used by factors. However, factoring services differ from other financial mechanisms used to improve the liquidity of companies. They often require that the factor scrupulously checks the other two parties, i.e., the company using the factoring services and the invoiced company. The need for a thorough analysis of documents, also in terms of false or empty invoices, the assignment of transaction limits for traditional factoring, the bank-like procedure for checking the financial credibility of the financed entity or the often limited (compared i.e., to electronic banking) forms of document signing mean that the expenses incurred per transaction can be very high.

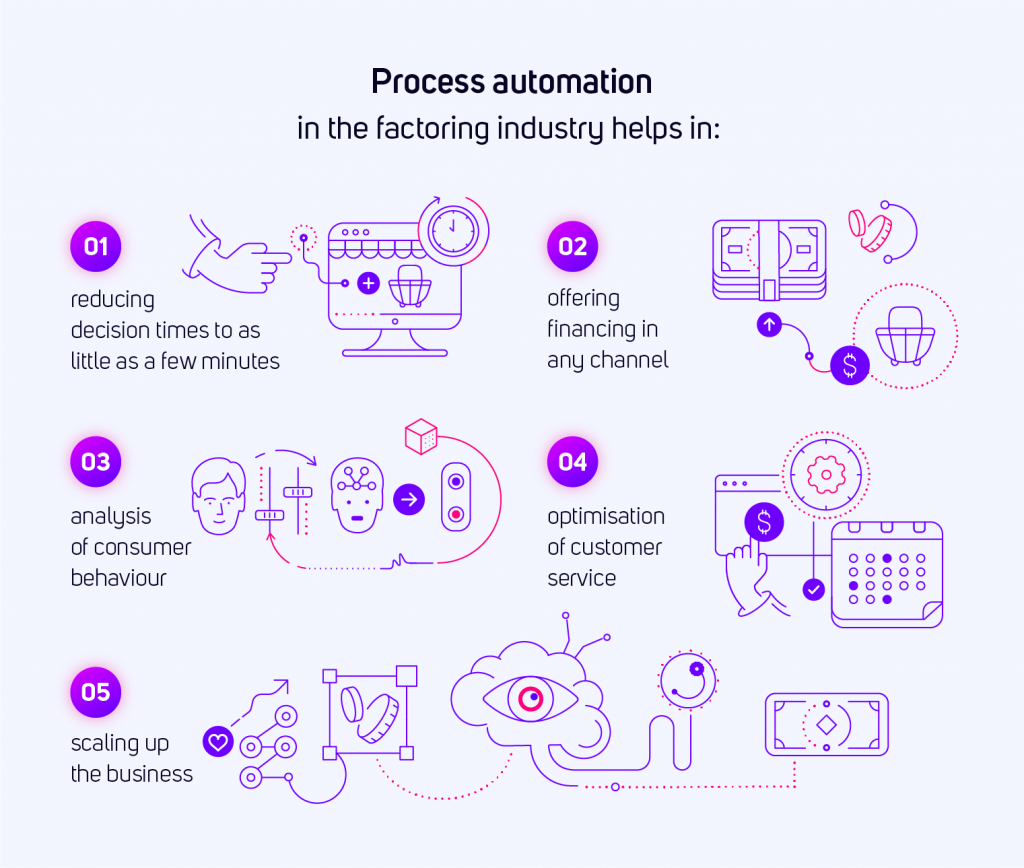

Embedded Finance is a way of effectively shortening many of the processes that take place; from customer acquisition to funding decisions and much of the after-sales service. To grow effectively and encourage small and medium-sized business owners to use factoring services, companies offering them need to prioritise convenience and an easy access path. By embedding factoring services into existing software or platforms, we simplify the factoring process and reduce time and minimise effort for customers seeking financing.

In addition, embedding factoring services can help attract new customers who might not otherwise consider factoring as an option to improve a company’s cash flow. This is an opportunity to launch micro factoring, for example, as a new financial product in a factoring company. It is a crucial step toward building a factoring product, understood as a payment method rather than a complex product similar to a credit line. Customers simply need both the availability of the financing company and the financed product, at one place of business.

Integration with multiple external platforms

Putting Embedded Finance into practice primarily means integrating with e-commerce platforms. This integration enables factoring companies to extend their reach to new customers and provide a more seamless and convenient experience for existing ones. In this way, factoring companies can offer their finance at the point of sale or invoicing, making it easier to access factoring services when customers need them.

For example, embedding a factoring service on a retailer’s website makes it possible to offer factoring as a payment option, complementing existing solutions – such as simple loans, credits, or short-term ‘buy now, pay later’ (BNPL) offers. This type of integration also allows invoices to be easily sent to the factor without having to leave the platform, such as a shop or a wholesaler’s website.

More error-proof procedures and processes, all within the current IT ecosystem

The financial industry, including factoring, is particularly vulnerable to the consequences of human errors. In addition, customers are accustomed to the digital world and the fact that online cases are handled in as little as a dozen minutes. Factors can save time and costs in handling or onboarding customers by automating many procedures, including confirming customers’ identities or using cognitive mechanisms to streamline the application filling.

Automation can also support adaptation to the dynamically changing legal environment. For example – the factoring industry in Poland faces the need to adapt to the new National e-Invoicing System (KSeF). Automation allows a company to respond flexibly to such challenges and simultaneously change the course of many processes.

Process automation improves efficiency, reduces business costs, and facilitates compliance. As the banking sector continues its digital transformation, the factoring industry will also be adopting automation as it is increasingly important to be competitive. Furthermore, by analysing data, financial goals and consumer behaviour, AI-based systems can offer additional products to support factoring or other financial services. This leads to increased customer satisfaction and can help factoring companies build long-term relationships with their customers.

Until a few years ago, the implementation of Business Automation in a financial institution was a lengthy process and was associated with high costs, not only in terms of the implementation of the mechanisms themselves but also in terms of their maintenance or updating. The situation has changed with a shift in approach to building and implementing systems, including the use of a microservices architecture. This architectural approach in software development involves building applications from small, self-contained, and independent services. Each of these services can perform one specific function or be a direct reflection of the business domain at the system level. Thus, it can be developed, deployed, and scaled independently of the rest of the system.

The described system structure allows the automation of processes both with the use of BPM engines and through the appropriate orchestration of modules and built-in solutions of various platforms combining features of CRM, ECM or BPM systems. An excellent example of such a solution is our proprietary, modular Fintin platform. Each Fintin module can be implemented independently, each module can be integrated with external systems or with the financial institution’s solutions.

Increasing customer service automation with AI and AI-based chatbots

The introduction of automation in the handling of documents and internal procedures does not mean that human labour will be eliminated from the factoring process. Automation supports factoring staff by making their work more efficient and effective. When a large part of customer service tasks is already automated, it is time to go a step further toward using artificial intelligence in customer interactions. One possibility is AI-based chatbots, which significantly ease the burden of repetitive responses for employees and provide support for a significant number of problems for customers (24/7).

Designed by TUATARA, the Actionbot chatbot quickly and efficiently answers customer questions, solves their problems and provides immediate answers. Using the latest natural language processing and machine learning technologies, it offers a captivating customer experience that can help create a strong sense of loyalty and satisfaction.

By integrating chatbots into existing systems and platforms, factoring providers can offer a seamless and efficient customer experience. This can help improve customer satisfaction and loyalty, while streamlining the factoring process for the provider.