What is cognitive process automation?

Cognitive process automation can significantly enhance various aspects of an organisation by leveraging advanced technologies such as artificial intelligence (AI), machine learning (ML), natural language processing (NLP) and robotic process automation (RPA). Implementing these solutions requires specific knowledge and experience in various domains.

Read our article to learn more about cognitive technology in TUATARA.

For CPA to function correctly, it’s essential that all systems are well-integrated and that data origins and flows are clearly understood. This enables centralised data access and real-time processing, allowing CPA tools to analyse information holistically and generate timely insights.

Effective integrations enhance analytics by combining data from multiple sources, creating unified reports for comprehensive insights. They also provide scalability and flexibility, adapting to evolving business needs without disrupting existing systems, and improve user experience by streamlining processes and giving single interfaces for multiple systems.

Key technical skills needed for a well-implemented CPA include proficiency in programming languages such as Python, R, or Java, which are essential for developing and implementing AI and ML models. A strong foundation in data science is crucial, encompassing data preprocessing, model training, evaluation and deployment. Also, employees need skills in NLP for text analysis and language understanding. At the same time, broad knowledge of AI principles, including neural networks and cognitive computing, is necessary for developing sophisticated automation systems.

Industry-specific expertise is also important to tailor CPA solutions to unique business challenges, while a solid understanding of business process management helps in modelling workflows and optimising processes. Also, implementing CPA solutions requires strategic planning and execution, change management skills to train employees and ensure adoption, and a keen understanding of data security and regulatory compliance to protect sensitive information and adhere to standards.

Combining these skills enables organisations to successfully deploy and integrate CPA technologies, often through cross-functional teams or partnerships with specialised vendors.

How cognitive process automation streamlines business processes

Unlike traditional automation, which simply handles repetitive tasks, CPA employs machine learning and natural language processing to understand, learn, and adapt to complex processes. This intelligent automation streamlines business operations by reducing manual intervention, minimising errors, and accelerating decision-making.

Here are a few real-life examples showing how business processes can be simplified with cognitive process automation.

Intelligent document processing

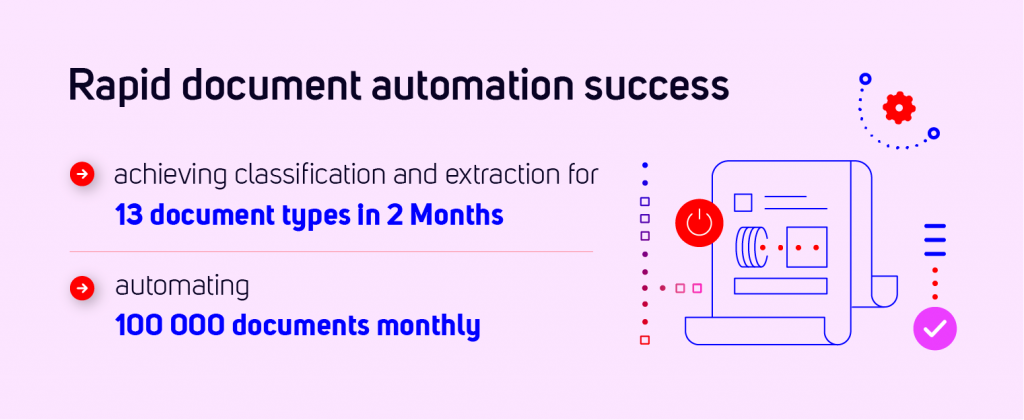

We implemented a CPA solution for a debt collection company that automates extracting, interpreting, and processing information from unstructured documents. Due to the withdrawal of their legacy solution from the Polish market, they also needed to classify and extract data from court and bailiff letters.

We’ve developed a new automated solution using a Software as a Service (SaaS) model. Key features included:

- Optical Character Recognition (OCR) of bailiff and court letters that allowed for automated reading of handwritten and printed text from legal documents.

- Developed models to classify 24 types of bailiff letters and 37 types of judicial letters, ensuring accurate categorisation and processing.

- Data extraction of critical information, such as reference numbers, dates, formal deficiencies, advance payments, and cancellations, for 13 specific types of bailiff letters.

The implemented solution significantly reduced the manual effort required for document processing, leading to faster resolution times and increased accuracy. The SaaS model also provided the flexibility to scale operations without disrupting existing systems. The cognitive process automation ensured the company’s consistent regulatory compliance and enhanced security by maintaining secure data flows. Finally, advanced data analytics enabled the company to gain deeper insights into its operations, improving decision-making and strategy development.

Data anonymisation

The banking company needed to enhance the security and compliance of personal data while implementing new automation solutions for document circulation. We’ve implemented a comprehensive data anonymisation solution that automatically identifies, marks, and anonymises personal data within documents using advanced technologies.

Key features of the solution included:

- Machine learning and rule-based models to automatically detect and identify personal data within documents.

- Data anonymisation tools, such as selected forms of erasure to anonymise personal data.

- OCR for converting documents into a machine-readable format.

- Support for handling multiple data formats, including PDF, DOC, JPG, MSG, EML, and TXT.

By implementing this data anonymisation solution, the company successfully safeguarded personal data while enhancing document circulation processes. Advanced technologies ensured compliance with data protection regulations and improved overall operational efficiency. The solution also reduced manual effort, increased accuracy, and enabled scalability for seamless integration with existing workflows.

Decision-making process automation

Santander Consumer Multirent sought to enhance its decision-making processes by implementing a new decision engine to accelerate the issuance of credit decisions, including automating these decisions. We’ve proposed a comprehensive approach to optimising and automating its business processes, particularly in sales and risk assessment.

The solution contained several key steps:

- Development and launch of the risk engine, based on IBM tools, tailored to the company’s needs.

- Integration of the decision engine with various report providers using around 20 APIs to gather necessary data for informed decision-making.

- Team training sessions to ensure effective use of the decision engine.

- Development of decision rules, enabling the formulation of policies and accurate risk assessment.

The new decision engine significantly speeds up the credit decision process, allowing for automatic approvals where applicable. It also streamlines key business processes, improving overall efficiency. We’ve implemented sophisticated decision rules that improve the accuracy and reliability of risk assessments. The seamless integration with multiple data sources ensures comprehensive and timely information for decision-making.

Customer service automation

A banking company aimed to optimise and digitise its sales and central processes to enhance efficiency and minimise errors. Key objectives included:

- Automating contract launch and verification processes.

- Accelerating document registration and assignment.

- Increasing overall work efficiency.

We’ve implemented the SensID platform as a central system for process automation and the SensID Cognitive Hand module for quick integration with domain systems lacking API access.

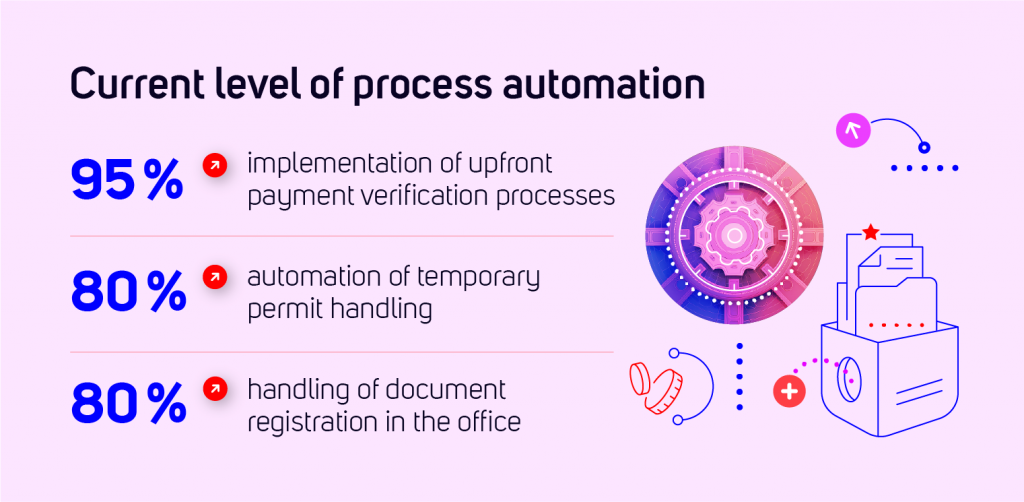

The cognitive process automation solution was a real success, with:

- Over 95% automation in verifying upfront fees, significantly reducing manual effort and processing time.

- Over 80% automation of the processes related to handling temporary permits, which streamlined operations and reduced delays.

- Over 80% automation in the registration of letters in the office, which accelerated document processing and minimised errors.

Implementing automation strategies optimised sales and central processes, enhancing the company’s overall operational performance.

After-sales support automation

Santander Consumer Multirent aimed to enhance its after-sales customer care by creating a modern, self-service online environment for customers. The goal was to digitise processes, improve customer service, and monitor task times to meet service level agreements (SLAs).

We’ve implemented a comprehensive system for submitting applications, monitoring schedules, managing leasing instalment repayments, obtaining consents, conducting operations, invoicing, and handling contracts.

The implementation covered several key activities:

- Development of a dashboard accessible via a web portal and a mobile app allowing customers to easily submit applications, monitor schedules, and manage their financial operations.

- Digitalisation of all after-sales processes and customer communication to streamline operations and reduce manual intervention.

- Implementation of task time monitoring to ensure adherence to SLAs, improving response times and service quality.

- A system for categorising customer applications and cases for more efficient processing and resolution.

By automating its after-sales processes, the company successfully created a modern, efficient, and customer-friendly service environment. Integrating a self-service portal and mobile application, digitised processes, and SLA monitoring led to substantial improvements in customer service and operational efficiency. This transformation enhanced the company’s image as a modern organisation and significantly improved its after-sales customer care capabilities.

Digitisation of financing processes

Santander Consumer Multirent aimed to transform its financing processes for vehicles and household items. The goals were to increase customer satisfaction in sales and after-sales processes, achieve greater flexibility in responding to market changes, and optimise and automate business processes by making them available online.

The digitisation process involved several key areas of focus:

- Development of an online platform to facilitate better collaboration and integration with partners.

- Implementation of digital tools to streamline operations and improve customer service efficiency.

- Creating a self-service portal for customers to manage their financing needs independently.

- Implementation of automated scoring systems for quicker and more accurate decision-making.

- Digitisation of the product catalogue, allowing easy updates and quick dissemination of new offers.

- Automation of after-sales processes to improve efficiency and customer satisfaction.

The digitalization of financing processes for vehicles and household items at Santander Consumer Multirent brought about a profound transformation. The company noticed a substantial boost in efficiency and service quality, enhancing customer satisfaction, increased market adaptability, and optimised business processes.

What benefits does cognitive process automation bring to organisations

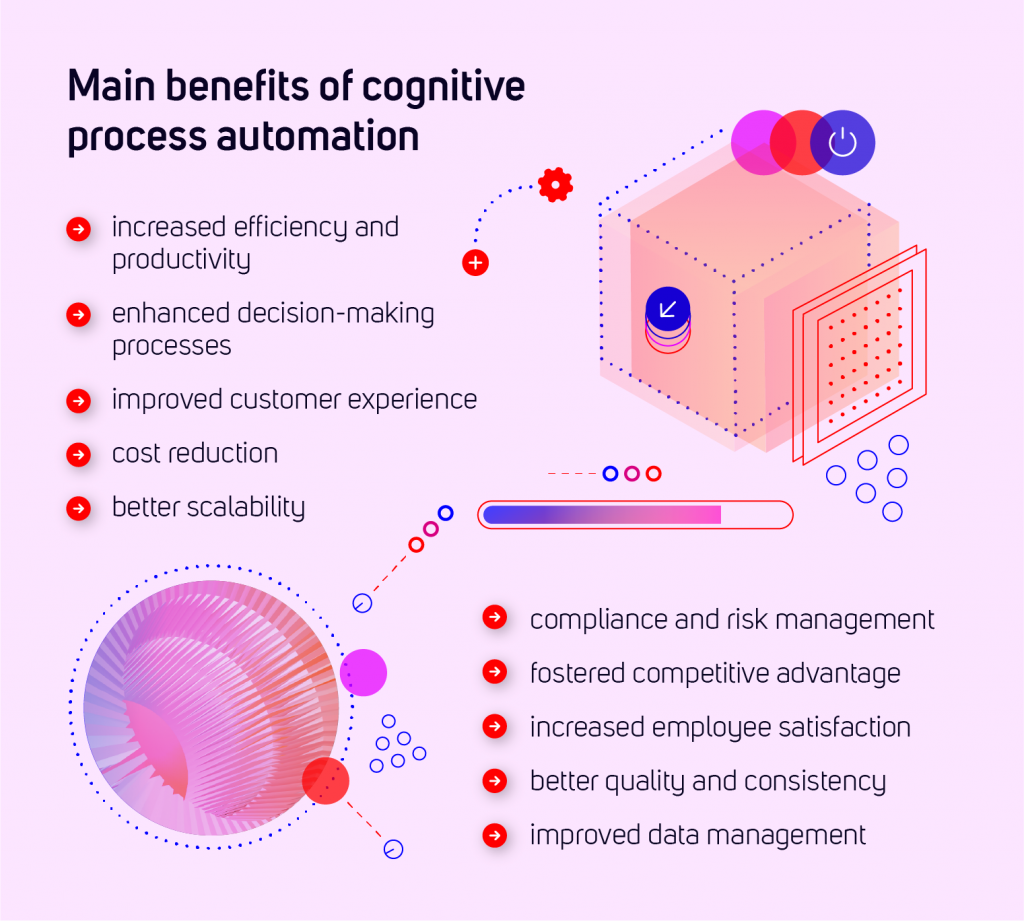

CPA offers many benefits to organisations, transforming how they operate. It enhances efficiency and accuracy across various business functions, drives innovation, improves customer experiences, and provides a competitive edge in the dynamic business landscape.

Here are some of the main benefits of including CPA in your business strategy.

Increased efficiency and productivity

CPA can handle repetitive, rule-based tasks that require cognitive functions, freeing employees to focus on more strategic activities. Reducing manual intervention increases the speed and accuracy of processes, minimising errors and the need for repeating tasks.

Enhanced decision-making processes

CPA can analyse vast amounts of data in real time, providing insights that help in making informed decisions. ML algorithms allow for the prediction of trends and outcomes, assisting in proactive decision-making and strategic planning.

Improved customer experience

Analysing customer data leads to offering personalised recommendations and solutions, ultimately increasing customer satisfaction. Chatbots and virtual assistants powered by CPA can provide all-time support, improving service levels and customer engagement.

Cost reduction

Automating processes reduces costs and operational inefficiencies. CPA ensures optimal use of resources by streamlining processes and eliminating bottlenecks.

Better scalability

CPA can easily handle increased workloads during peak times without compromising performance. Solutions powered by cognitive automation can be scaled up or down as the organisation grows, adapting to changing business needs.

Compliance and risk management

Nowadays, ensuring that processes adhere to regulatory requirements is crucial. That’s why cognitive process automation consistently applies privacy rules and monitors for compliance. It can also help identify and mitigate risks early by providing real-time data and analytics.

Fostered competitive advantage

CPA streamlines business processes, fostering innovation and continuous improvement so that organisations can adapt quickly to market changes, staying ahead of competitors who rely on traditional processes.

Increased employee satisfaction

By taking over mundane tasks, cognitive automation allows employees to focus on more meaningful and engaging work that requires creative and critical thinking. Ultimately, it fosters their skill development and job satisfaction.

Better quality and consistency

Cognitive process automation ensures that tasks are performed consistently according to defined standards, enhancing overall quality. Automated processes reduce the likelihood of human errors, leading to more reliable outcomes.

Improved data management

Finally, cognitive automation can integrate data from various sources, providing a unified view and improving data management. It allows for real-time data processing and analytics, which succeed in timely and relevant data.

How cognitive process automation supports transformative improvements in organisations

Cognitive process automation supports transformative processes in organisations by integrating advanced technologies such as AI, ML and NLP. By seamlessly connecting disparate systems and data sources, it enhances efficiency, accuracy, and decision-making processes. It also enables real-time data processing and comprehensive analytics, leading to more informed and proactive strategies. Ultimately, it fosters innovation, scalability, and agility, driving significant improvements in business performance and competitive advantage.

Contact us if you are wondering whether your company is ready to implement cognitive process automation. We’ll explain the whole process and propose a personalised offer.